SBI Under Fire as Aggressive Credit Card Reminder Sparks Customer Outrage

4 min read

Chandigarh: A heated controversy has erupted after an SBI recovery agent allegedly sent an aggressive and offensive reminder to a credit card user over a small overdue payment. The customer, Rattan Dhillon, took to social media platform X (formerly Twitter) to expose the harsh tone used by the agent, calling the bank’s approach “unacceptable” and threatening legal action.

Customer Shares Shocking Message from SBI Agent

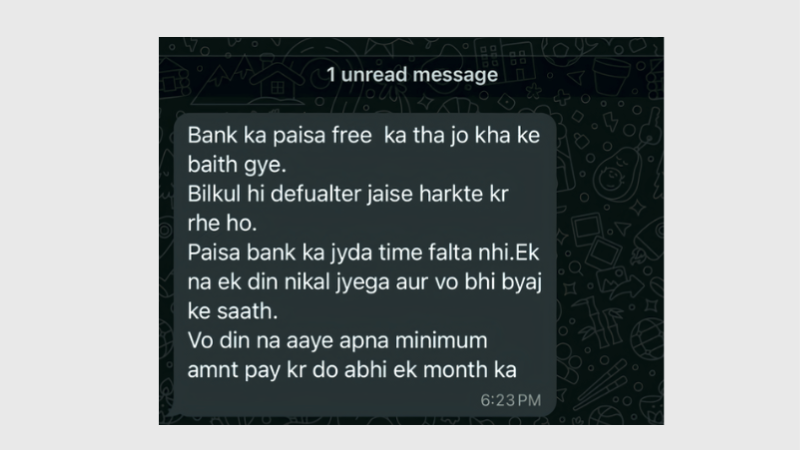

Rattan Dhillon, a Chandigarh-based customer, shared a WhatsApp screenshot of the message he received from the State Bank of India’s (SBI) recovery department. The message, written in an accusatory and aggressive tone, read:

“Bank ka paisa free ka tha jo kha ke baith gae? Bilkul hi defaulter jaise harkate kar rahe ho. Paisa bank ka zyada time nahi falta. Ek na ek din nikal jaega aur vo bhi byaj ke sath. Vo din na aaye, apna minimum amount pay kar do abhi ek month ka.”

(Translation: “Was the bank’s money free that you just used it and sat back? You’re acting exactly like a defaulter. The bank’s money doesn’t stay stuck for long—one way or another, it will be recovered, and that too with interest. Before that day comes, pay your minimum amount for this month.”)

Expressing his anger, Dhillon wrote:

“Can you believe this isn’t a fraud text? Yes, it’s an official message from SBI! The audacity to send something like this is unbelievable.”

He further explained that upon checking his records, he found he had an outstanding credit card balance of just ₹2,000-₹3,000, and the representative verified all his details, confirming that she was indeed from SBI’s recovery team.

Look at the post below:

Can you believe this isn’t a fraud text!Yes, it’s an official message from SBI! The audacity to send something like this is unbelievable.

— Rattan Dhillon (@ShivrattanDhil1) February 18, 2025

Upon checking, I found that I had a small credit card due of 2-3k, and the representative verified all my details—she was indeed from SBI.… pic.twitter.com/4f4UAsnXk5

Legal Threat and Account Closure Warning

Furious over the language used, Dhillon demanded an official apology from the bank. He warned that if SBI fails to take appropriate action, he would:

- File a formal complaint against the bank

- Close all his accounts with SBI immediately

Calling the experience “absolutely pathetic,” Dhillon asserted that such behavior from a financial institution was unprofessional and unacceptable.

SBI Responds to the Viral Controversy

As Dhillon’s post gained traction on social media, SBI responded publicly, acknowledging the issue and assuring corrective action.

“We sincerely regret the inconvenience caused. We have taken note of it & our representative will connect with you soon,” SBI wrote in reply to the viral post.

Despite the apology, netizens and banking customers across social media platforms expressed concerns over SBI’s debt recovery tactics and demanded better training and ethical practices for recovery agents.

Understanding the Debt Recovery Controversy

This incident has reignited debate over the aggressive tactics used by some banks in recovering overdue payments. Key concerns raised include:

- Harassment by recovery agents: Several customers have previously reported cases of verbal abuse, intimidation, and mental harassment.

- Lack of professional conduct: Customers expect formal, polite reminders rather than insulting and aggressive messages.

- Data privacy concerns: The ease with which agents access customer details raises concerns about data protection and misuse.

- Legal implications: Threatening or using derogatory language can lead to legal action against financial institutions under consumer protection laws.

A Pattern of Complaints?

While this specific case has gone viral, SBI is not the first bank to face backlash for aggressive debt recovery tactics. In recent years, multiple Indian banks have been accused of:

- Misusing customer data for high-pressure recovery calls

- Employing third-party agencies with poor regulatory oversight

- Violating RBI guidelines on ethical debt collection

What Are RBI Guidelines on Loan Recovery?

The Reserve Bank of India (RBI) has issued clear guidelines prohibiting coercive tactics in loan recovery. As per RBI rules:

- Banks must maintain professionalism while interacting with borrowers.

- Agents must not use threats, intimidation, or offensive language.

- Repeated calls and harassment of customers are strictly prohibited.

- Legal action can be taken against banks violating these norms.

With this incident now under scrutiny, SBI may face further investigation into whether its recovery practices adhere to regulatory standards.

What Happens Next?

As of now, SBI has not disclosed if any disciplinary action has been taken against the recovery agent involved. However, given the customer backlash and widespread media coverage, the bank is likely to review its:

- Training protocols for recovery agents

- Complaint redressal mechanisms

- Debt collection policies to align with ethical standards

Follow India Prime Times for more news and analysis on the latest happenings across the nation.

Disclaimer: The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of India Prime Times